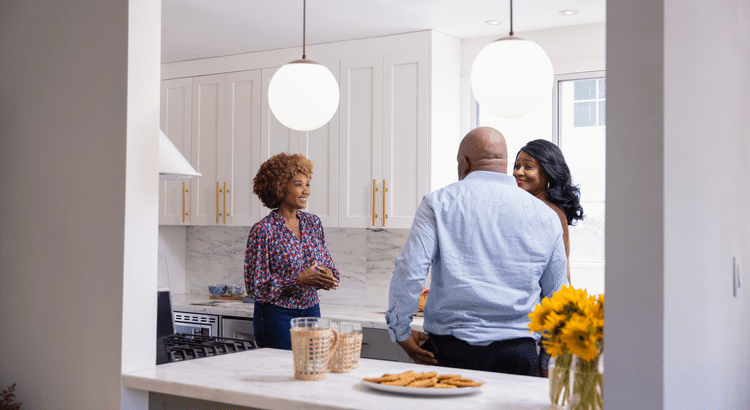

The Biggest Mistakes Buyers Are Making Today

Buyers face challenges in any market – and today’s is no different. With higher mortgage rates and rising prices, plus the limited supply of homes for sale, there’s a lot to consider. But, there's one way to avoid getting tripped up – and that’s leaning on a real estate agent for the best possible advice. An expert’s insights will help you avoid some of the most common mistakes homebuyers are making right now. Putting Off Pre-approval As part of the homebuying process, a lender will look at your finances to figure out what they’re willing to loan you for your mortgage. This gives you a good idea of what you can borrow so you can really wrap your head around the financial side of things before you start looking at homes. While house hunting can be a lot more fun than talking about finances, you don’t want to do this out of order. Make sure you get your pre-approval first. As CNET explains: “If you wait to get preapproved until the last minute, you might be scrambling to contact a lender and miss the opportunity to put a bid on a home.” Holding Out for Perfection While you may have a long list of must-haves and nice-to-haves, you need to be realistic about your home search. Even though your ideal state is you find a home that checks every box, you may need to be willing to compromise – especially since inventory is still low. Plus, a home that has everything you want may be too pricey. As Investopedia puts it: “When you expect to find the perfect home, you could prolong the homebuying process by holding out for something better. Or you could end up paying more for a home just because it meets all your needs.” Instead, look for something that has most of your must-haves and good bones where you can add anything else you may need down the line. Buying More House Than You Can Afford With today’s mortgage rates and home prices, there’s no arguing it’s expensive to buy a home. And while it may be tempting to stretch your finances a bit further than you’re comfortable with to make sure you get the house, you want to avoid overextending your budget. Make sure you talk to your agent about how changing mortgage rates impact your monthly payment. Bankrate offers this advice: “Focus on what monthly payment you can afford rather than fixating on the maximum loan amount you qualify for. Just because you can qualify for a $300,000 loan doesn’t mean you can comfortably handle the monthly payments that come with it along with your other financial obligations. Every borrower’s case is different, so factor in your whole financial profile when determining how much house you can afford.” Not Working with a Local Real Estate Agent This last one may be the most important of all. Buying a home is a process that involves a lot of steps, paperwork, negotiation, and more. Rather than take all of this on yourself, it’s a good idea to have a pro working with you. The right agent will reduce your stress and help the process go smoothly. As CNET explains: “Attempting to buy a home without a real estate agent makes the process more arduous than it needs to be. A real estate agent can give you professional legal guidance, market expertise and support, which will save you time, money and stress. They can also increase your chances of finding the right home so you don’t have to spend hours scouring the internet for listings.” Bottom Line Mistakes can cost you time, frustration, and money. If you want to buy a home in today’s market, let’s connect so you have a pro on your side who can help you avoid these missteps.

The Top 2 Reasons To Consider a Newly Built Home

When you’re planning a move, it’s normal to wonder where you’ll end up and what your future home is going to look like. Maybe you’ve got a specific picture of that house in your mind. But unless you came into this process knowing you want to buy a newly built home, you may not have pictured new home construction. A trusted real estate agent can help walk you through these two reasons you may want to reconsider that. 1. Adding Newly Built Homes Could Give You More Options There are two types of homes on the market: new and existing. A newly built home refers to a house that was just built or is under construction. An existing home is one a previous homeowner has already lived in. Right now, the inventory of existing homes is tight. But there may be options for you on the new home side of things. Data from the Census and the National Association of Realtors (NAR) shows that newly built homes are a bigger part of today’s housing inventory than the norm (see graph below): From 1983 to 2019 (the last normal year in the market), newly built homes made up only 13% of the total inventory of homes for sale. But today that number has climbed to over 33%. Rest assured, after over a decade of underbuilding, builders aren’t overdoing it today. Even with an increase in new construction today, there’s still a significant housing shortage overall. But for you, the uptick in new builds can be a game changer because it gives you more options for your search. 2. Newly Built Homes May Be More Affordable Than You’d Think You may still be wondering if a new build could really be an option for you. If you’ve previously written them off because you thought they would be out of your budget, consider this. The price gap between a newly built home and an existing house is shrinking. Here's why. Builders are going to build what’s in demand. And they know people need more options right now, especially ones that are smaller and potentially more affordable. So, they’re focusing on building smaller homes at lower price points. The graph below shows the price difference between new and existing homes is shrinking as that happens: As LendingTree explains: “In the past, newly built homes have been much more expensive than existing homes — but that gap has been getting smaller recently. In some places today, you may find that the cost to build versus buy is roughly the same.” And an article from CNBC says: “While new builds are still sold for slightly more than existing homes, the price gap has significantly narrowed . . .” Not to mention, some builders are even offering price cuts and mortgage rate buy-downs right now to sweeten the deal. Today there are many reasons new builds may be worth considering. Other buyers sure seem to think so. As Freddie Mac says: "As the supply of existing homes for sale remains low and home prices continue to rise, more buyers are choosing to purchase new homes than in previous years." Just know that buying a newly built home isn’t the same as buying an existing one. Builder contracts have different fine print. So, partner with a local agent who knows the market, builder reputations, and what to look for in those contracts so you have an expert on your side to help you explore this option. Bottom Line If you want to find out what builders are doing in our area, let’s connect and check it out together. And if you’re willing to cast a wider net to open up your options even more, we can talk about broadening your search to include other towns nearby.

What Is Going on with Mortgage Rates?

You may have heard mortgage rates are going to stay a bit higher for longer than originally expected. And if you’re wondering why, the answer lies in the latest economic data. Here’s a quick overview of what’s happening with mortgage rates and what experts say is ahead. Economic Factors That Impact Mortgage Rates When it comes to mortgage rates, things like the job market, the pace of inflation, consumer spending, geopolitical uncertainty, and more all have an impact. Another factor at play is the Federal Reserve (the Fed) and its decisions on monetary policy. And that’s what you may be hearing a lot about right now. Here’s why. The Fed decided to start raising the Federal Funds Rate to try to slow down the economy (and inflation) in early 2022. That rate impacts how much it costs banks to borrow money from each other. It doesn't determine mortgage rates, but mortgage rates do respond when this happens. And that’s when mortgage rates started to really climb. And while there’s been a ton of headway seeing inflation come down since then, it still isn’t back to where the Fed wants it to be (2%). The graph below shows inflation since the spike in early 2022, and where we are now compared to their target rate: As the graph shows, we’re much closer to their goal of 2% inflation than we were in 2022 – but we’re not there yet. It's even inched up a hair over the last 3 months – and that’s having an impact on the Fed’s plans. As Sam Khater, Chief Economist at Freddie Mac, explains: “Strong incoming economic and inflation data has caused the market to re-evaluate the path of monetary policy, leading to higher mortgage rates.” Basically, long story short, inflation and its impact on the broader economy are going to be key moving forward. As Greg McBride, Chief Financial Analyst at Bankrate, says: “It’s the longer-term outlook for economic growth and inflation that have the greatest bearing on the level and direction of mortgage rates. Inflation, inflation, inflation — that’s really the hub on the wheel.” When Will Mortgage Rates Come Down? Based on current market data, experts think inflation will be more under control and we still may see the Fed lower the Federal Funds Rate this year. It’ll just be later than originally expected. As Mike Fratantoni, Chief Economist at the Mortgage Bankers Association (MBA), said in response to the Federal Open Market Committee (FOMC) decision yesterday: “The FOMC did not change the federal funds target at its May meeting, as incoming data regarding the strength of the economy and stubbornly high inflation have resulted in a shift in the timing of a first rate cut. We expect mortgage rates to drop later this year, but not as far or as fast as we previously had predicted.” In the simplest sense, what this says is that mortgage rates should still come down later this year. But timing can shift as new employment and economic data come in, geopolitical uncertainty remains, and more. This is one of the reasons it’s usually not a good strategy to try to time the market. An article in Bankrate gives buyers this advice: “ . . . trying to time the market is generally a bad idea. If buying a house is the right move for you now, don’t stress about trends or economic outlooks.” Bottom Line If you have questions about what’s happening in the housing market and what that means for you, let’s connect.

Categories

Recent Posts